How to Set Up SQL Accounting Software (2025 Guide)

A step-by-step tutorial for beginners to configure and launch SQL Accounting Software for business use – updated for 2025.

Published 04 July 2025

In this article, you will learn about

1. System Requirements & Preparation

2. Installing SQL Accounting Software

3. Creating a New Company Profile

4. Setting Up Core Accounting Structure

5. Configuring Inventory (Optional)

6. Inputting Opening Balances

7. Daily Operations Overview

8. Maintenance Tips & Best Practices

In this article, you will learn about

1. Why Is Accounting Important for Malaysian Businesses?

2. Overview of Malaysia’s Accounting Environment

3 .Types of Accounting Relevant to Malaysian SMEs

4. Core Accounting Terminology You Should Know

5. The Accounting Cycle: From Transaction to Report

6. Key Financial Statements Explained

7. Understanding Business Taxes in Malaysia

8. Choosing Between Cash Basis and Accrual Basis Accounting

9. Recommended Accounting Software for SMEs

10. Should You DIY or Hire an Accountant?

11. Common Accounting Mistakes to Avoid

12. How to Hire a Good Accountant in Malaysia

Accounting is often seen as complex and intimidating, especially for first-time entrepreneurs. But in Malaysia, where SMEs form over 97% of all business establishments, understanding the basics of accounting is not just helpful — it's essential. This guide breaks down everything you need to know, whether you're launching a new business, running a startup, or growing your small enterprise.

Why Is Accounting Important for Malaysian Businesses?

Accounting is the backbone of every successful business operation. In Malaysia, it’s more than just a way to track expenses or submit taxes. It’s a fundamental tool for making informed decisions, gaining investor trust, and ensuring legal compliance with authorities like the Inland Revenue Board (LHDN).

When businesses maintain proper accounting practices, they gain clarity in their finances, which leads to:

• Stronger financial decision-making

• Easier access to business loans or investments

• Smooth and timely tax submissions

• Early detection of cash flow issues

• Effective budget planning and forecasting

Failing to implement sound accounting can lead to penalties, disqualification from grants, and even business closure.

Overview of Malaysia’s Accounting Environment

Malaysia follows structured financial guidelines under local and international accounting standards. These standards determine how companies record, report, and interpret their financial transactions.

The key players in Malaysia's financial regulatory landscape include:

• Lembaga Hasil Dalam Negeri (LHDN): Oversees tax compliance for individuals and companies

• Companies Commission of Malaysia (SSM): Regulates company registration, annual filings, and financial disclosures

• Malaysian Institute of Accountants (MIA): Sets ethical and professional standards for licensed accountants

Accounting standards include:

• Malaysian Financial Reporting Standards (MFRS): For public interest entities

• Malaysian Private Entities Reporting Standards (MPERS): For SMEs and private companies

Understanding the obligations set by these bodies helps SMEs stay compliant and avoid regulatory risks.

Types of Accounting Relevant to Malaysian SMEs

There are multiple branches of accounting. For small businesses, some are more relevant than others:

• Financial Accounting: Prepares reports for external parties like investors and tax bodies based on historical data.

• Management Accounting: Used internally for decision-making, budgeting, and cost analysis.

• Tax Accounting: Ensures compliance with Malaysian tax laws, including corporate tax and SST.

• Bookkeeping: Involves daily recording of transactions such as sales, purchases, and expenses.

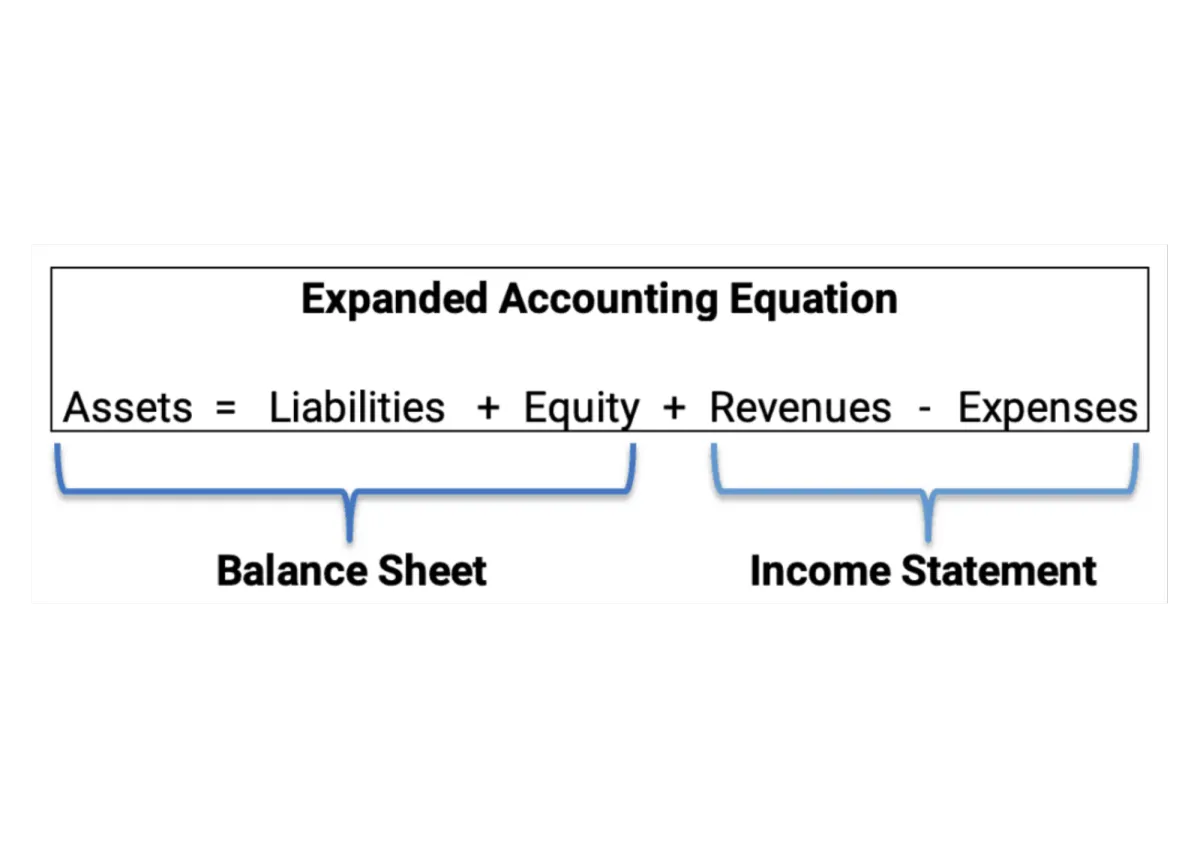

Core Accounting Terminology You Should Know

Before diving into financial reports, it's essential to understand these terms:

• Assets: Resources your business owns (e.g., cash, inventory, vehicles)

• Liabilities: Debts or obligations (e.g., loans, unpaid bills)

• Equity: Owner’s stake in the business after deducting liabilities from assets

• Revenue: Income from sales or services

• Expenses: Costs incurred to operate the business

• Profit/Loss: Net result after comparing revenue and expenses

Grasping these terms empowers entrepreneurs to read financial statements confidently.

The Accounting Cycle: From Transaction to Report

Understanding the accounting cycle helps you stay organized and consistent. The process typically includes:

1. Recording financial transactions

2. Entering each into a journal

3. Posting to the ledger

4. Conducting a trial balance

5. Adjusting for accruals and depreciation

6. Preparing financial statements

7. Closing the books for the next period

Following this cycle ensures your records are complete, timely, and audit-ready.

Key Financial Statements Explained

Every business should produce the following reports regularly:

Income Statement

Also known as a profit and loss statement, this shows profitability over a specific period. It includes:

Revenue

Cost of Goods Sold (COGS)

Operating Expenses

Net Profit or Loss

Balance Sheet

A snapshot of your financial position, listing:

Assets

Liabilities

Equity

Cash Flow Statement

Tracks how cash moves in and out of your business and helps assess liquidity.

Together, these three statements provide a comprehensive view of business performance.

Understanding Business Taxes in Malaysia

Taxation is a major part of accounting. Every SME owner in Malaysia should know:

• Corporate Income Tax: 17% on the first RM600,000 (for SMEs), 24% above that

• Personal Income Tax: Progressive, from 0% to 30%

• SST (Sales and Service Tax): Replaced GST in 2018

• Withholding Tax: Applies on payments to non-residents

Important: Corporate tax filings are usually due within seven months of your financial year-end.

Choosing Between Cash Basis and Accrual Basis Accounting

Both methods are accepted in Malaysia, but the choice depends on your business needs.

• Cash Basis: Records income/expenses when cash is received or paid. Suitable for freelancers or micro businesses.

• Accrual Basis: Records income/expenses when earned or incurred, regardless of cash flow. Better for SMEs seeking growth and accurate forecasting.

Recommended Accounting Software for SMEs

These tools are popular in the Malaysian market:

• SQL Account: SST-compliant and widely used among SMEs

• AutoCount: Offers payroll, inventory, and accounting features

Should You DIY or Hire an Accountant?

Many entrepreneurs start with DIY accounting to save costs. This gives control but risks errors.

Hiring a professional provides:

• Higher accuracy and compliance

• Tax planning support

• Time savings

• Professional financial reporting for investors or banks

If your business is scaling or preparing for funding, a certified accountant is a smart move.

Common Accounting Mistakes to Avoid

Avoid these pitfalls:

• Mixing personal and business funds

• Not keeping receipts or source documents

• Ignoring unpaid invoices

• Missing tax deadlines

• Not backing up your financial records

Being proactive helps you maintain credibility and control.

How to Hire a Good Accountant in Malaysia

Ask the right questions:

• Are they MIA certified?

• Do they have SME experience?

• Do they use cloud-based tools?

• Are their fees transparent?

Interview more than one accountant and ask for client references.

Conclusion

Understanding accounting in Malaysia is not just about staying legal — it’s about building a business that thrives. Whether you’re running a bakery in Melaka, a tech startup in Cyberjaya, or a design studio in Johor Bahru, mastering your numbers will give you clarity, control, and confidence.

Accounting might seem overwhelming at first, but with the right systems, support, and mindset, it becomes one of your most powerful business tools.

FAQs

Do I need to hire an accountant if I’m just starting my business in Malaysia?

Not necessarily. Many small business owners start by handling basic bookkeeping themselves using accounting software. However, as your business grows, hiring a certified accountant ensures better compliance and financial planning.

What accounting method is best for Malaysian SMEs: cash or accrual?

The accrual method is usually better for SMEs as it gives a more accurate picture of your business performance. Cash basis may work for freelancers or very small service providers.

What happens if I miss my tax submission deadline in Malaysia?

Late filing may result in penalties and surcharges from LHDN. For companies, tax returns must be submitted within seven months after the end of the financial year. Always set reminders or work with an accountant to stay compliant.