E-Invoicing Malaysia Guidelines

Author: Chris Business Solutions

Oct: 28,2024

The e-Invoicing initiative in Malaysia was first introduced by the government in the 2023 Budget announcement, presented in October 2022. During the budget speech, the government introduced e-Invoicing as part of a broader digital tax reform to improve tax compliance and efficiency. This unforeseen news was like a thunderclap bomb for many business owners, as they struggled with unexpected challenges and confusion regarding compliance, leaving them uncertain about the next steps.

To get businesses ready for the implementation, we have prepared this comprehensive e-invoicing Malaysia guidelines. From understanding e-invoice requirements to seamlessly integrating into your business operation, we’ve got everything covered for you.

In this article, you will learn about:

What is E-Invoicing in Malaysia?

E-invoicing also known as electronic invoicing, is a digital record of a transaction between a seller (supplier) and a buyer (purchaser). In Malaysia, this digital document goes through a government portal (MyInvois) in real time, ensuring the e-invoice is validated and securely recorded.

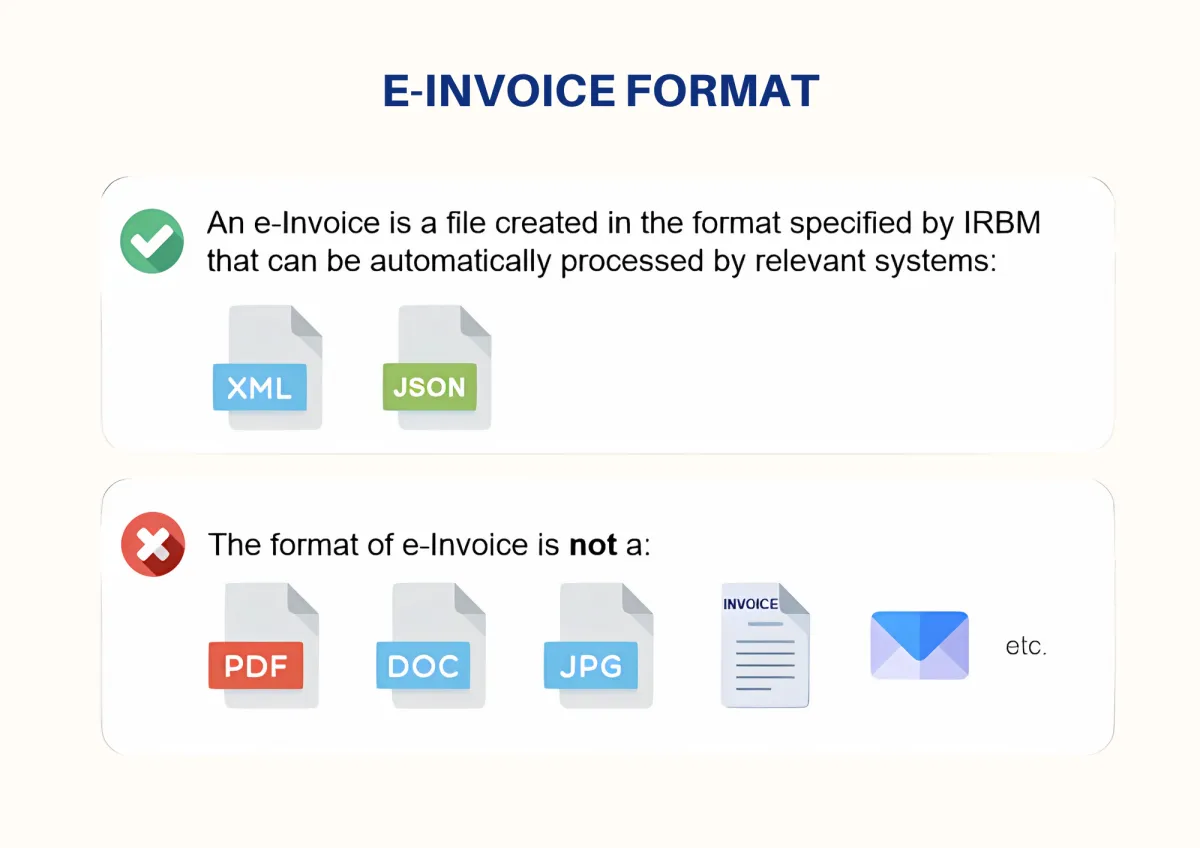

E-Invoice is only supported in XML and JSON format, and there are 55 required data fields, organized into eight categories:

1) Address

2) Business Details

3) Contact Number

4) Invoice Details

5) Parties

6) Party Details

7) Payment Info

8) Products/Services Offered

E-Invoicing Implementation Timeline in Malaysia

The rollout of E-Invoice Malaysia is set to be carried out in three phases. Each phase is structured based on pre-determined turnover or revenue thresholds, giving businesses ample time to adapt.

The start dates of e-invoicing are as follow:

| Not Exempted Entities | Exempted Entities | Exempted Income or Expense Types |

|---|---|---|

| Associations | Ruler and ruling chief | Employment income |

| Body of persons | Former ruler and ruling chief | Pension |

| Branches | Consort of a ruler of a state with specified titles | Alimony |

| Business trusts | Government | Dividend distribution (in specific circumstances) |

| Co-operative societies | State government and state authority | Zakat |

| Corporations | Government authority | Contract value for buying/selling securities or derivatives on a stock exchange (local or foreign) |

| Limited liability partnerships | Local authority | Disposal of shares of a company not listed on a stock exchange, except when disposer is a company, LLP, trust, or co-operative society |

| Partnerships | Statutory authority and statutory body | |

| Property trust funds | Facilities provided by the above government, authority, or body | |

| Property trusts | Consular offices and diplomatic officers, consular officers, and consular employees | |

| Real estate investment trusts | Individual who is not conducting business | |

| Representative offices and regional offices | Taxpayers with annual turnover/revenue of less than RM150,000 | |

| Trust bodies | ||

| Unit trusts |

Understand how the annual turnover or revenue will be determined:

1) Businesses with audited financial statements: Use the annual turnover or revenue from the statement of comprehensive income in their audited financial statements for the year 2022.

2) Businesses without audited financial statements: Use the annual revenue reported in their tax return for the 2022 assessment year.

3) If a business changed its accounting year-end for 2022: The turnover or revenue will be adjusted to reflect a full 12-month period to determine the e-Invoicing implementation date.

Is E-Invoicing Mandatory?

E-Invoice is mandatory for all taxpayers undertaking commercial activities in Malaysia, regardless of the industry you're in. However, there are still some special exemptions, as well as specific types of income or expenses that are not subject to e-Invoicing requirements. Below are the details:

Not Exempted Entities

✅Associations

✅Body of persons

✅Branches

✅Business trusts

✅Co-operative societies

✅Corporations

✅Limited liability partnerships

✅Partnerships

✅Property trust funds

✅Property trusts

✅Real estate investment trusts

✅Representative offices and regional offices

✅Trust bodies

✅Unit trusts

Exempted Entities

✅Ruler and ruling chief

✅Former ruler and ruling chief

✅Consort of a ruler of a state with specified titles

✅Government

✅State government and state authority

✅Government authority

✅Local authority

✅Statutory authority and statutory body

✅Facilities provided by the above government, authority, or body

✅Consular offices and diplomatic officers, consular -officers, and consular employees

✅Individual who is not conducting business

✅Taxpayers with annual turnover/revenue of less than RM150,000

Exempted Income or Expense Types

✅Employment Income

✅Pension

✅Alimony

✅Dividend distribution (in specific circumstances)

✅Zakat

✅Contract value for buying/selling securities or derivatives on a stock exchange (local or foreign)

✅Disposal of shares of a company not listed on stock exchange, except when disposer is a company, LLP, trust, or co-operative society

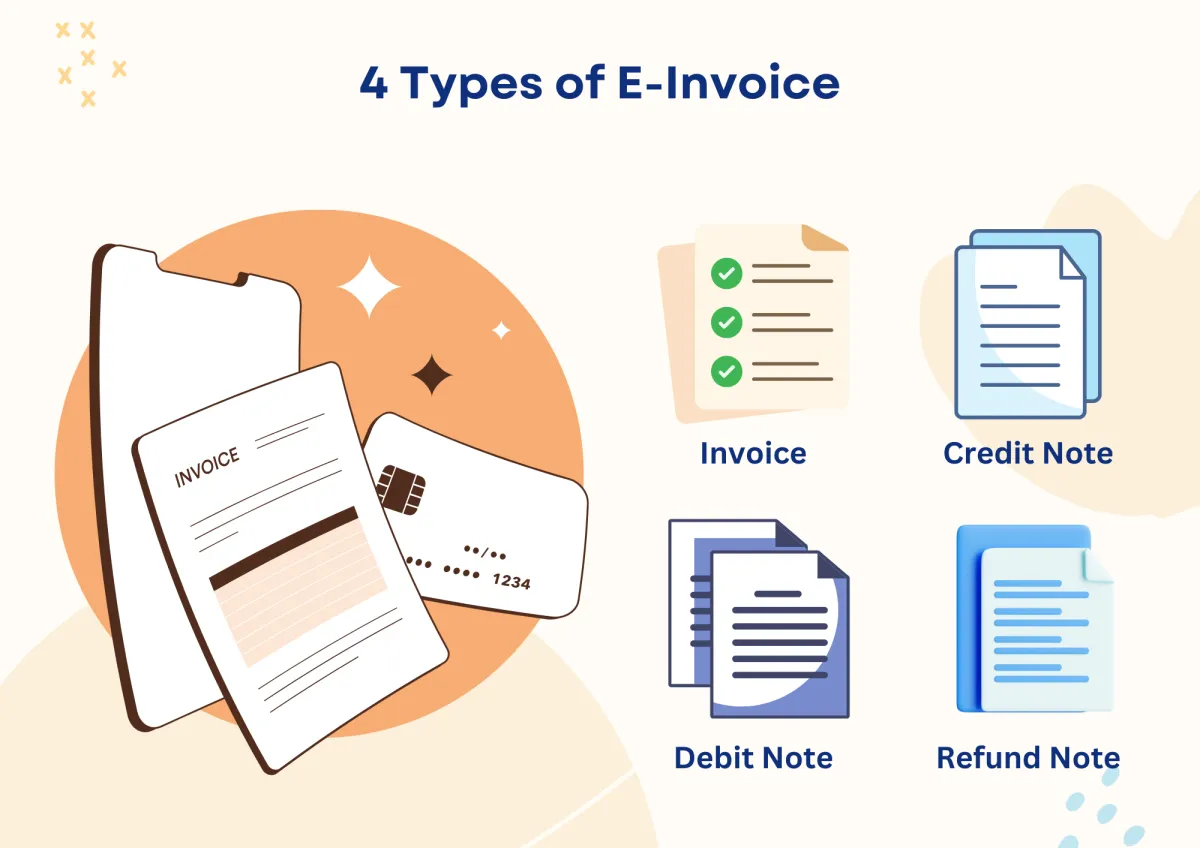

Scenario and Types of E-Invoice

Scenario of E-Invoice to be issued:

Proof of income: Issued whenever a sale or other transaction takes place to recognise the income of taxpayers.

Proof of expense: Used for purchases, expenses, returns, discounts, and to adjust income records. Taxpayers may issue a self e-Invoice for expenses like foreign transactions.

1) Invoice: A document detailing a transaction between Supplier and Buyer, including self-billed e-Invoices for documenting expenses.

2) Credit Note: Issued to correct errors, apply discounts, or account for returns on a previous e-Invoice, reducing its value without refunding money to the Buyer.

3) Debit Note: Issued to add extra charges to a previous e-Invoice.

4) Refund Note: Confirms a refund to the Buyer, used when money is returned.

How Does E-Invoicing Work?

The process for generating an e-invoice in Malaysia differs based on the e-invoicing model (API or MyInvois Portal) and whether the transaction is B2B or B2C. Nevertheless, most steps in the procedure remain the same as follow.

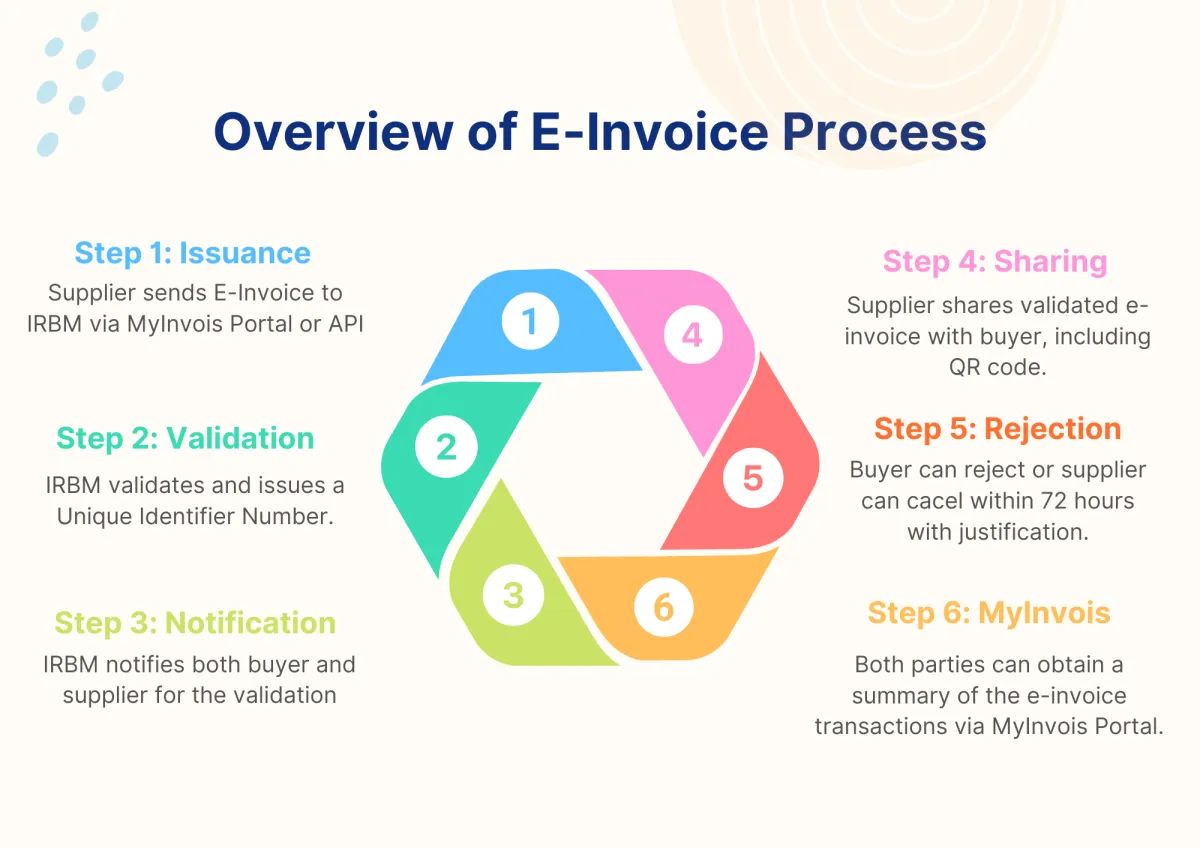

Overall Process of E-Invoice

Issuance of E-Invoice: When a sale or transaction occurs (including e-Invoice adjustments), the supplier creates an e-Invoice and submits it to the IRBM through the MyInvois Portal or API for validation.

Validation of E-Invoice: The IRBM performs real-time validation to ensure the e-Invoice meets required standards. Upon successful validation, the supplier receives a Unique Identifier Number via the MyInvois Portal or API.

Notification of Validated e-Invoice: Once validated, both supplier and buyer are notified through the MyInvois Portal or API.

Sharing of e-Invoice: After validation, the supplier must provide the verified e-Invoice (with an embedded QR code) to the buyer. The QR code allows verification of the e-Invoice’s authenticity and status via the MyInvois Portal.

Rejection or Cancellation of e-Invoice: The buyer or supplier can reject or cancel the e-Invoice within 72 hours of validation, provided they offer justification.

MyInvois Portal Access: Both supplier and buyer can request and access e-Invoice data through the MyInvois Portal.

There are buyers, particularly end consumers and specific businesses, do not need an e-invoice. Therefore, the generation of e-invoices for B2C transactions varies based on the buyer's requirements:

When the Buyer Requests an E-Invoice: Suppliers collect information from the buyer or consumer and generate e-invoices in real time, similar to the process for B2B e-invoices.

When the Buyer Does Not Require an E-Invoice: The IRBM permits suppliers to consolidate transactions with buyers who do not need an e-invoice into a single monthly consolidated e-invoice.

Type of E-Invoice Models

There are two types of e-invoicing models available in Malaysia: one is through the government portal (MyInvois), and the other is through API with third-party service providers. Below is a breakdown of the differences:

MyInvois Portal

A portal hosted by IRBM/LHDN, available to taxpayers as an free option for e-invoicing. This portal is ideal for Micro, Small, and Medium-sized Enterprises (MSMEs) or companies with lower transaction volumes due to the need for manual data entry.

For instructions on how to log in for the first time, visit this MyInvois Portal Login and e-invoice generation guide.

API Model

An API (Application Programming Interface) is a set of programming codes that allows direct communication between the taxpayer’s system and the MyInvois System. This integration enables the automatic generation, sending, receiving, and correction of e-invoices directly through their systems, making it possible to handle large volumes of transactions in real-time.

Recognizing the complexity of this integration, the Lembaga Hasil Dalam Negeri (LHDN) has introduced the

e-invoice Malaysia Software Development Kit (SDK).

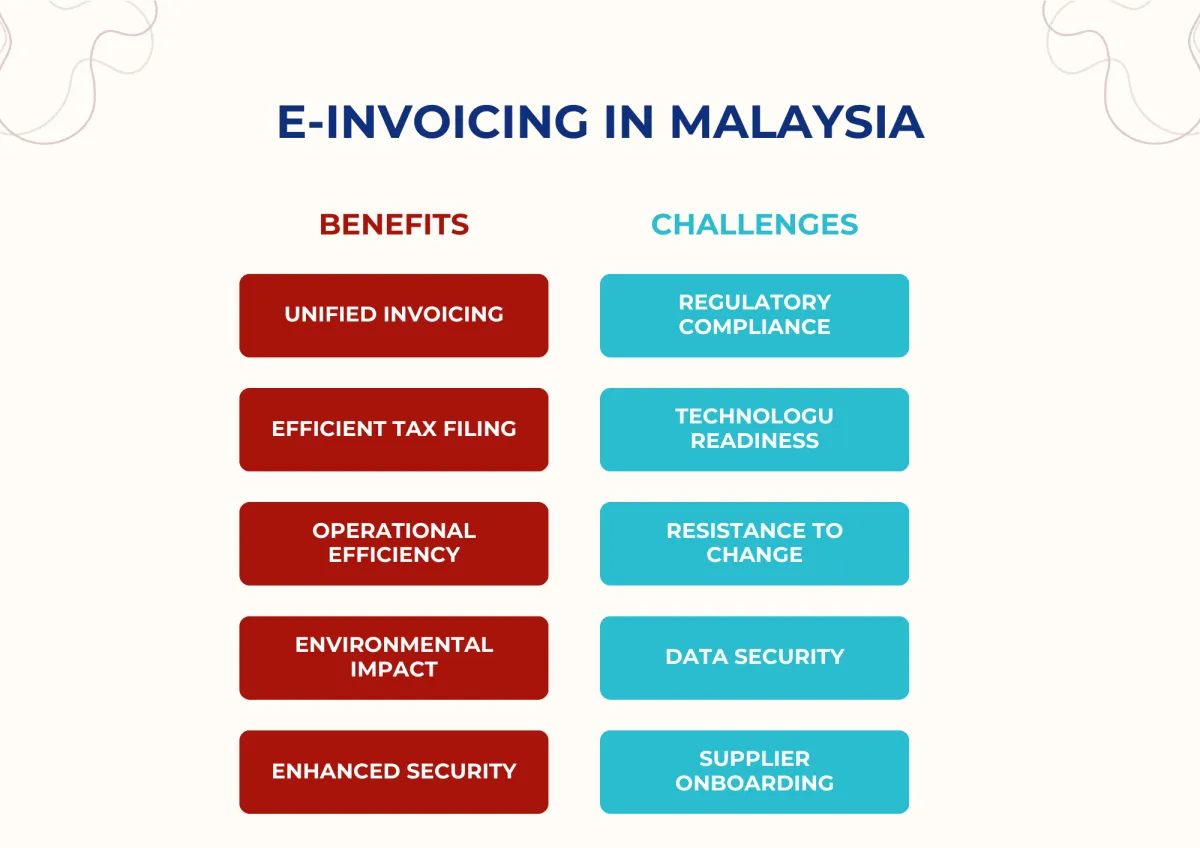

The Benefits of E-Invoicing In Malaysia

Implementing e-Invoicing provides taxpayers with a smooth experience while enhancing business efficiency and tax compliance. The benefits include:

Unified Invoicing: Simplifies the creation and submission of invoices, reducing manual work and errors through automation.

Efficient Tax Filing: E-Invoicing can be seamlessly integrated with accounting software, ERP, and other business management systems, streamlining workflows and ensuring data consistency.

Operational Efficiency: Businesses can benefit from improved processes, saving time and costs through automation and better invoice management.

Environmental Impact: By reducing paper usage and promoting digital transactions, e-Invoicing contributes to sustainability efforts and reduces a business's carbon footprint.

Enhanced Security: E-Invoicing systems often include encryption and secure access controls, reducing the risk of fraud and unauthorized access to sensitive financial data.

The Challenges of E-Invoicing In Malaysia

There are also challenges to be overcome before businesses can smoothly embrace e-invoicing; here are some key obstacles:

Regulatory Compliance: Businesses must ensure their e-invoicing systems align with the MyInvois system and adhere to specific standards for data submission and reporting, which can be particularly challenging for businesses with complex accounting practices.

Technological Readiness: Smaller businesses may lack the necessary IT infrastructure for e-Invoicing. Upgrading systems to meet e-Invoicing standards can be resource-intensive, requiring a shift from manual to automated processes.

Resistance to Change: Employees used to traditional invoicing methods may resist adopting e-Invoicing, necessitating effective change management strategies.

Data Security and Integration: As financial data is transmitted electronically, companies must ensure data security and privacy. Integrating e-Invoicing with existing systems like ERP requires careful planning to maintain data accuracy and consistency.

Supplier Onboarding: Getting suppliers to adopt e-Invoicing can be difficult, as ensuring all partners are aligned with the new procedures and technology may take time.

How To Prepare Your Business for E-invoicing?

To access the readiness of your businesses for e-invoicing implementation in Malaysia, here are some steps you can follow:

People: Evaluate the skill sets of your staff regarding e-invoicing and digital tools. Conduct training sessions to ensure they understand the new systems and processes. Engaging employees early in the transition can help reduce resistance to change and improve overall adoption.

Technology: Assess your existing IT infrastructure to determine if it can support e-invoicing solutions. This includes evaluating your accounting software, integration capabilities, and data management systems. You may need to upgrade or replace systems to ensure seamless integration with e-invoicing platforms.

Compliance: Familiarize yourself with the regulatory requirements related to e-invoicing in Malaysia. Ensure that your invoicing practices align with the guidelines set by the IRBM and other relevant authorities. This includes adhering to data submission standards and reporting obligations.

Supplier and Customer Engagement: Communicate with your suppliers and customers about the upcoming changes. Determine their readiness for e-invoicing and address any concerns they may have. Collaboration with trading partners can facilitate a smoother transition and ensure alignment on new processes.

Data Security: Evaluate your data security measures to protect sensitive financial information. Ensure that your systems comply with data protection regulations and implement robust security protocols to prevent unauthorized access and data breaches.

Conclusion

The implementation of e-invoicing in Malaysia marks a significant step toward modernizing the country’s invoicing and tax collection systems, and this transition is poised to benefit every businesses. Though it may be a challenging process for many business owners to adapt during the initial phases, however, in the long term, the advantages such as increased efficiency and reduce errors will definitely far outweigh the initial difficulties. It is advisable for businesses to start evaluating their current technological capabilities and find out which e-invoice models best suit them.

If you're seeking a reliable e-invoicing solution provider, look no further than Chris Business Solution. With our extensive expertise in e-invoicing, we have developed an easy-to-use e-invoicing software (HeroInvoice) to help businesses stay compliant with the latest e-invoicing regulations.

The implementation of E-Invoicing should be easy and seamless. Start your journey towards enhanced efficiency today—contact us now!

FAQs

How to Register for E-Invoice on the LHDN MyTax MyInvois Portal?

To register for e-invoicing on the LHDN MyTax MyInvois portal, follow these steps:

✅Visit the MyTax portal.

✅Log in with your registered ID or create an account if you're a new user.

✅Go to the MyInvois section, select the e-invoicing option, and follow the prompts to register your business details.

✅Once registration is complete, you’ll receive confirmation, allowing you to access e-invoicing services through the portal.

What is the Difference Between an E-Invoice and a Normal Invoice?

An e-invoice is a digital version of an invoice that is generated, sent, and stored electronically in compliance with government standards. It includes structured data that can be directly processed by accounting and tax systems. A normal invoice, on the other hand, is typically a paper or PDF document and may require manual data entry. E-invoices are also more secure, reduce errors, and ensure regulatory compliance, unlike traditional invoices.

How Do I Check if an E-Invoice is Valid?

To verify the validity of an e-invoice, you can use the MyInvois portal:

✅Log into the MyTax portal and navigate to the e-invoice verification section.

✅Enter the invoice number or other required details to check its authenticity.

✅The system will confirm if the e-invoice is registered and valid under the LHDN database.

How to Print an E-Invoice?

To print an e-invoice:

✅Access the e-invoice from your e-invoicing software or the MyInvois portal.

✅Select the print option, which will format the e-invoice for printing.

✅Make sure to select a secure printer if handling sensitive data, and store printed copies according to your business’s record-keeping requirements.

What Happens if an E-Invoice is Not Made?

If an e-invoice is not created or reported correctly, your business may face compliance issues, which could result in penalties or fines. Additionally, without an e-invoice, tax reporting may be inaccurate, leading to potential audit risks or delayed tax processing. E-invoicing ensures accurate reporting and helps businesses avoid such complications by meeting regulatory standards.