How To File Corporate Income Tax In Malaysia

Filing corporate income tax in Malaysia is something every business must do to stay compliant with the country’s tax laws. It doesn’t matter if your company is big or small – this process applies to all businesses. And here’s the thing: failing to file your taxes on time can lead to serious consequences, like penalties, fines, and even legal action from the Inland Revenue Board of Malaysia (LHDN). So, it's crucial to stay on top of this and make sure everything is filed properly and on time, and this guide will help you navigate the process with ease and ensure you're fully prepared to meet your tax obligations.

In this article, you will learn about:

What is Corporate Income Tax In Malaysia?

First, let's understand that Corporate income tax in Malaysia is a direct tax that applies to the profits earned by companies operating within the country. Whether a company is a resident or a non-resident, if it generates income from Malaysia, it’s subject to this tax.

Corporate Income Tax Rate

Resident Companies

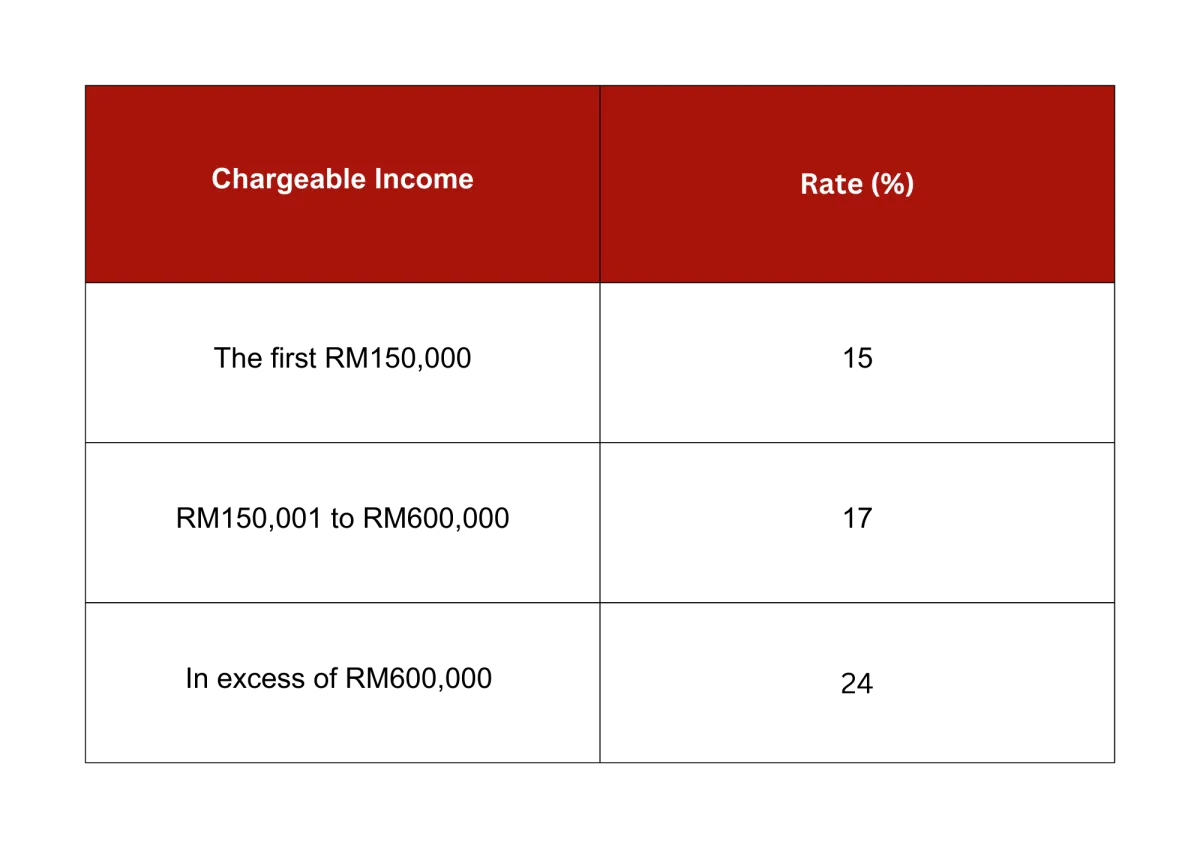

Resident companies are subject to a 24% tax rate, while companies with a paid-up capital of RM2.5 million or less* and gross business income not exceeding RM50 million are taxed according to the following scale rates:

Note that companies must not be part of a group where any related company has a paid-up capital exceeding RM2.5 million. Additionally, starting from the Year of Assessment 2024, no more than 20% of the company’s paid-up capital can be owned (directly or indirectly) by companies incorporated outside Malaysia or by non-Malaysian citizens.

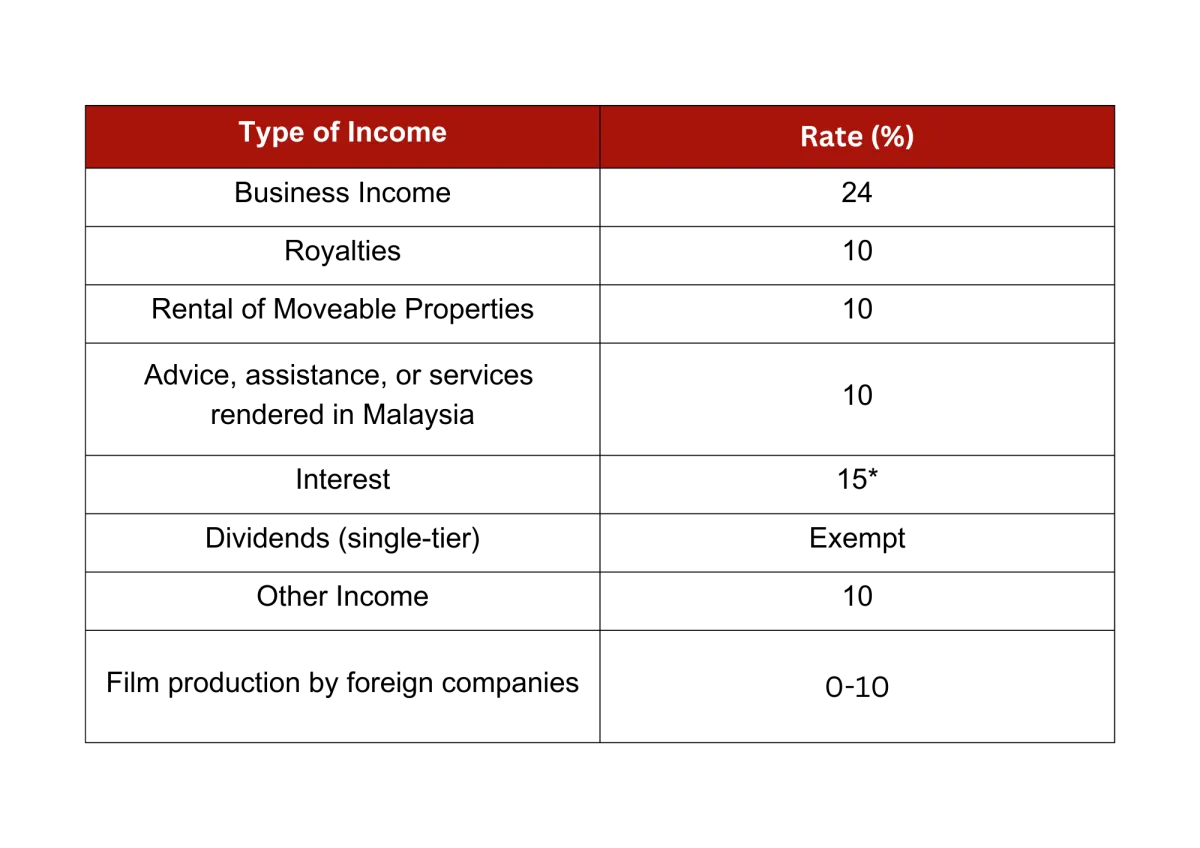

Non-Resident Companies

Non-resident companies are subject to the following tax rates:

Note: If the recipient is a resident of a country that has a double tax treaty with Malaysia, the tax rates on specific income sources may be reduced. Interest paid to a non-resident by a bank or finance company in Malaysia is exempt from tax.

Corporate Income Tax Deductible Expenses

Understanding corporate income tax deductible expenses is crucial for your businesses to optimize tax liabilities and remain compliant with tax regulations. By knowing which expenses are eligible for deductions, companies can effectively reduce taxable income, thereby lowering the amount of tax needed to pay.

In Malaysia, only expenses that are wholly and exclusively incurred in generating business income are eligible for deduction. Below are the details:

Salary and wages

Business insurance

Advertisement and promotion expenses

Employee travelling expenses

Entertainment expenses

Repair and maintenance

Lease rental on plaints and machinery

Recruitment expenses

Incorporation expenses

Some of the non-deductible expenses are:

Fines and penalties

Registration of trademarks

Non-approved donations

Domestic, private or capital expenditure

Employee's contribution to unapproved pensions, provident or saving schemes

Interest, royalty, contract payment, technical fees, rental of moveable property, payment to a non-resident public entertainer or other payments made to non-residents which are subject to withholding tax, but the tax was not paid

Corporate Tax Incentives & Exemptions

Understanding tax incentives are another big part of filing corporate income tax in Malaysia to help your business reduce tax liability. Here are some of the main incentives and exemptions available:

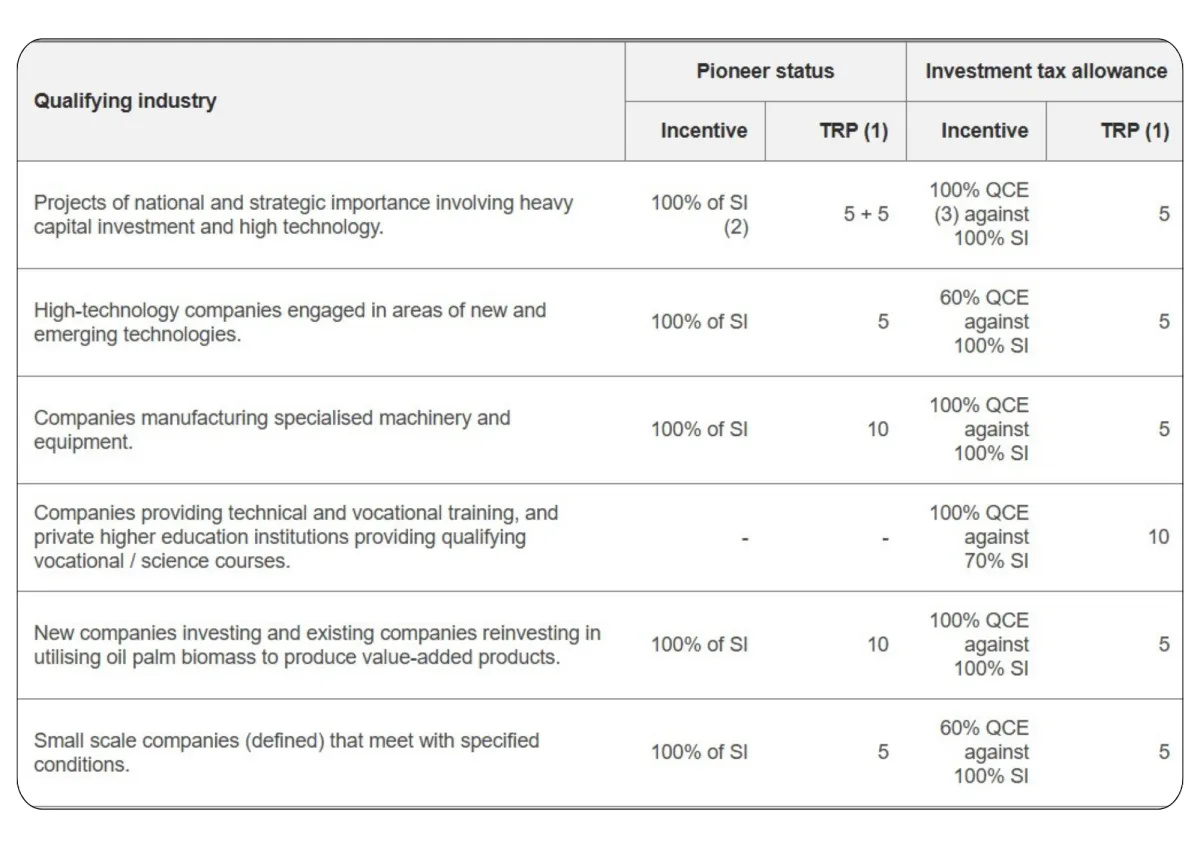

Pioneer Status (PS) and Investment Tax Allowance (ITA)

If your company is in industries like agriculture, hotel and tourism, manufacturing, or any other industrial or commercial sector, and you're involved in a promoted activity or producing a promoted product, you're in luck. You could be eligible for either Pioneer Status (PS) or Investment Tax Allowance (ITA) – both of which can significantly benefit your business.

Here’s how it works:

If your company gets Pioneer Status (PS), you’re granted a five-year corporate income tax exemption on 70% of your statutory income. That means you’ll only pay taxes on 30%, which will be taxed at the regular corporate income tax rate.

On the other hand, with Investment Tax Allowance (ITA), your company gets 60% of your qualifying capital expenditure (QCE)

as an allowance. This allowance is available over a period of five years and can be used against 70% of your statutory income, with the remaining 30% taxed at the usual corporate rate.

Both PS and ITA are fantastic ways to reduce your tax liability, and they’re there to support businesses like yours that are contributing to key sectors in Malaysia.

Abbreviation note: TRP = Tax Relief Period (In term of years), SI = Statutory Income, QCE = Qualifying Capital Expenditure

Reinvestment Allowance (RA)

The Reinvestment Allowance is available to companies that have been operating for 36 months or more and wish to reinvest in expanding, modernizing, or automating their business, particularly in the manufacturing or agricultural sectors.

Companies can claim 60% on qualifying capital expenditures (QCE), which can be used to offset 70% of their statutory income. The remaining 30% is taxed at the normal corporate tax rate. The incentive is available for 15 years, starting from the year the company first claims it.

Approved Service Projects

Companies in sectors such as transportation, communication, utilities, and services subsectors that the Ministry of Finance approves are eligible for specific tax incentives. Incentive options are as below:

60% Investment Allowance: The allowance applies to qualifying capital expenditure sustained over five years, utilized against 70% of statutory income.

Income Tax Exemption: A 70% exemption from income tax on statutory income for five years.

International Trading Companies

Companies classified as international trading companies can benefit from a five-year tax exemption on 20% of total export revenue, up to a maximum of 70%. To qualify, the company must meet the following requirements:

Be incorporated in Malaysia with at least 60% Malaysian ownership.

Achieve a minimum revenue of RM 10 million annually.

Use local services such as banking, financing, and insurance as well as local infrastructure.

Principle Hub

A Principal Hub is a business based in Malaysia that serves as a regional or international base for managing key operations like risk management, strategic decision-making, and finance. These businesses benefits from flexible foreign exchange policies and no ownership restrictions. Tax incentives are as below:

0% to 5% corporate tax rate for new companies for a period of 5+5 years or 10% corporate tax rate for existing companies for five years.

Customs duty exemptions for raw materials, repackaging materials, and finished products used by the principal hub.

Automation Capital Allowance (ACA)

This incentive encourages companies to adopt automation technologies in their operations. It is available to companies in the manufacturing and services sectors that meet specific criteria.

Companies can claim 200% on qualifying capital expenditures (QCE) related to automation machinery, equipment, software, or systems. These expenditures must include elements from Industry 4.0, such as cloud computing, artificial intelligence, or augmented reality.

Companies must have been in business for at least 36 months, and the capital expenditure must exceed MYR 10 million.

Research and Development (R&D) Incentives

Companies involved in contract R&D services, in-house R&D, or the commercialization of resource-based R&D findings are eligible for various tax incentives:

Contract R&D Companies: Eligible for Pioneer Status or Investment Tax Allowance on 100% of QCE for up to 10 years, utilized against 70% of statutory income.

In-house R&D: Companies conducting R&D internally can receive 50% ITA on qualifying capital expenditures.

Commercialization of R&D: Companies that finance resource-based R&D projects can claim a 100% tax exemption on statutory income for 10 years.

Green Technology Incentives

The Green Technology Incentives encourage companies to adopt environmentally sustainable practices, particularly in the areas of renewable energy, energy efficiency, and green buildings.

Tier 1: ITA of 100% of QCE against 70% of statutory income for qualifying projects such as battery storage systems and green buildings.

Tier 2: ITA of 60% of QCE for activities related to renewable energy projects and energy efficiency.

Businesses engaged in solar leasing or the manufacture of electric vehicle (EV) charging equipment can also access tax exemptions or allowances for these eco-friendly projects.

Solar leasing companies benefit from a 70% income tax exemption on statutory income for up to five or ten years, based on energy production capacity. This incentive aims to promote solar energy projects in Malaysia.

New and existing companies involved in the manufacturing of EV charging equipment in Malaysia are eligible for incentives to support the adoption of electric vehicles, including a 100% tax exemption on statutory income from 2023 to 2032 and a 100% Investment Tax Allowance (ITA) on qualifying capital expenditure (QCE) incurred for five years, which can be fully utilized against statutory income.

4 Steps to File Corporate Income Tax in Malaysia

Now you’ve got a good idea of the tax rates your business falls under, the expenses you can deduct, and the tax incentives you’re eligible for. With all that in mind, it’s time to talk about how to actually get started with filing your corporate income tax in Malaysia.

Step 1: Determine Your Basis Period

The first step in filing corporate income tax is to determine your basis period, and here’s why it’s so important. The basis period sets the exact timeframe for which your company’s income will be assessed. It ensures that everything lines up with your financial year, avoids any overlaps or gaps, and keeps you compliant with tax regulations. Plus, it’s crucial for correctly applying deductions and exemptions. Without a clear basis period, you can’t calculate your taxes accurately—that’s why this step comes first!

Step 2: Prepare and Maintain Proper Financial Records

Now, this is where things can start to feel a little overwhelming—keeping track of all those financial records, statements, and receipts. It’s no small task! You need everything in order: profit and loss statements, balance sheets, income and expense records, and proper documentation for deductions and related-party transactions. And if transfer pricing is involved, don’t forget that transfer pricing documentation report—it’s not optional.

But here’s the good news: you don’t have to do it all manually. Tools like SQL and AutoCount accounting software can take the heavy lifting off your shoulders. These systems can automate the process, making it faster, easier, and way less stressful. So, while proper record-keeping is essential—and yes, it can be tricky—it doesn’t have to be a headache when you’ve got the right tools to help!

Step 3: Submit Form CP204 (Estimated Tax Payable)

With all the necessary documents ready and prepared, it’s time to move on to submit Form CP204 (Estimated Tax Payable). This is where you declare your company’s estimated tax payable for the year. You can submit this either through e-filing (e-CP204) or directly to the LHDNM Processing Centre.

If your company is new, you’ll need to file your estimated corporate income tax within three months from the start of operations. For existing companies, the estimated tax payable must be filed at least 30 days before the start of the new basis year. Once submitted, the estimated tax will be paid in monthly installments.

Step 4: Complete Form C

With your estimated taxes in order, the next step is to tackle Form C, which is the official income tax return form for corporate entities. The Inland Revenue Board (IRB) will issue this form based on your company’s accounting period, and you should receive it at least three months before the submission deadline. Once received, you can complete and submit the form either through e-filing (e-C) or at the LHDNM Processing Centre. It’s crucial to fill out Form C accurately and ensure that all income, deductions, and tax reliefs are reported correctly to avoid any issues later on. This step wraps up the final stage of preparing your company’s tax return!

Key Deadlines:

Submission of Form CP204: 3 months before the start of the basis period.

Corporate Tax Filing Deadline: 7 months after the financial year-end.

FAQs

What is the penalties of late payment for corporate income tax in Malaysia?

According to LHDN, If the balance of tax payable is not paid by the due date, a 10% penalty will be imposed on the outstanding amount.

Should private limited companies pay corporate income tax in Malaysia?

Yes, private limited companies (Sdn Bhd) in Malaysia are required to pay corporate income tax on their profits. These companies are taxed at a standard rate of 24%. However, smaller companies with paid-up capital below RM2.5 million and a gross income of not more than RM50 million may be eligible for reduced tax rates or other tax incentives, depending on their specific circumstances.

How to calculate corporate income tax?

To calculate corporate income tax in Malaysia, follow these steps:

✅Determine taxable income: Start with your company’s total income and subtract any deductible expenses (e.g., salaries, rent, utilities, depreciation) to determine the taxable income.

✅Apply the tax rate: Multiply the taxable income by the corporate income tax rate (24% for most companies). For companies with qualifying conditions, reduced tax rates may apply.

✅Account for tax incentives and rebates: Apply any tax incentives (e.g., Pioneer Status, Investment Tax Allowance) or rebates that your business qualifies for, which may lower your taxable income or reduce the tax payable.

✅Final tax liability: Subtract any pre-paid taxes or tax credits (e.g., tax paid on dividends or through tax withholding) from the calculated tax to determine how much tax your company needs to pay.

It's always a good idea to consult with a tax advisor or use tools like accounting software to ensure you are accurately calculating and filing your tax return based on the latest regulations.