Step-by-Step Guide to Filing SST in Malaysia with Accounting Software

A step-by-step tutorial for beginners to configure and launch SQL Accounting Software for business use – updated for 2025.

Published 12 June 2025

In this article, you will learn about

1. System Requirements & Preparation

2. Installing SQL Accounting Software

3. Creating a New Company Profile

4. Setting Up Core Accounting Structure

5. Configuring Inventory (Optional)

6. Inputting Opening Balances

7. Daily Operations Overview

8. Maintenance Tips & Best Practices

In this article, you will learn about

1. What Is SST and Who Needs to File It?

2. Why Use Accounting Software to File SST?

3. Step-by-Step Guide to Filing SST with Accounting Software

4. Bonus Tips to Stay Compliant

5. Common Mistakes to Avoid

6. Conclusion: Future-Proof Your SST Filing

Managing Sales and Service Tax (SST) compliance is a key responsibility for Malaysian businesses. Since SST was reintroduced in September 2018 to replace the Goods and Services Tax (GST), many SMEs have struggled to adjust to the new system, particularly in how they prepare and submit their SST filings. Manual record-keeping and last-minute reporting are common pain points that expose businesses to penalties, audit risks, and unnecessary stress.

In this guide, we break down how Malaysian SMEs can file SST more efficiently using accounting software. From preparation to submission, this step-by-step tutorial aims to help you stay compliant, reduce errors, and take full advantage of automation tools.

What Is SST and Who Needs to File It?

The Sales and Service Tax (SST) in Malaysia comprises:

• Sales Tax (5% or 10%): Applied to manufacturers and importers.

• Service Tax (6%): Imposed on selected service providers (e.g., hotels, restaurants, consulting services).

You are required to file SST if:

• Your taxable turnover exceeds the prescribed threshold (e.g., RM500,000/year for most services).

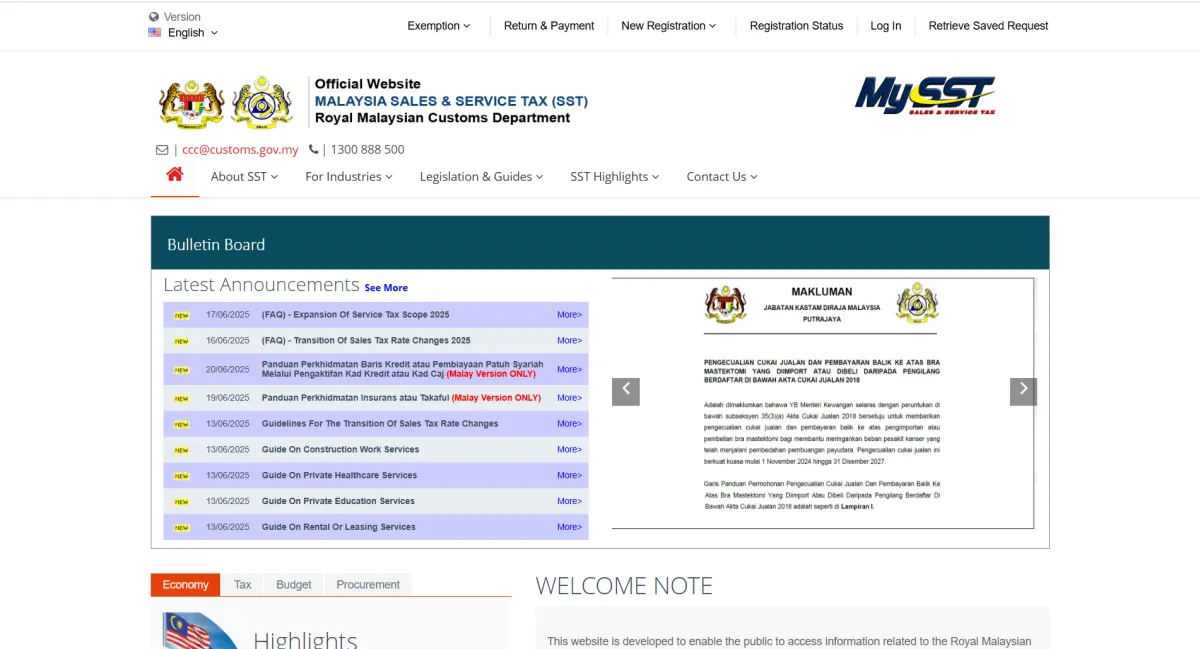

• You are registered with the Royal Malaysian Customs Department (RMCD) for SST.

Filing is typically done bi-monthly (every two months), and failure to file or late filing will incur penalties.

Why Use Accounting Software to File SST?

Using modern accounting software tailored for Malaysian businesses can:

• Automate SST calculations (sales, service, exemptions)

• Track taxable transactions in real-time

• Generate SST-02 forms with accurate data

• Store historical filing records securely for audits

Cloud-based platforms like AutoCount, SQL Account, Xero (with Malaysian plugins), and Financio are designed to handle SST modules effectively.

Choose Database Type

• For single-user: save the database locally

• For multi-user: select SQL Server as the backend and configure accordingly

Step-by-Step Guide to Filing SST with Accounting Software

Step 1: Ensure Your Software Is SST-Ready

Before anything else, confirm that your accounting software:

• Is SST-compliant (approved or recommended by local accountants)

• Supports SST tax codes, custom rates, and generates SST-02 forms

• Is updated with the latest Customs regulations

You may need to activate the SST module in your settings or get your vendor to assist.

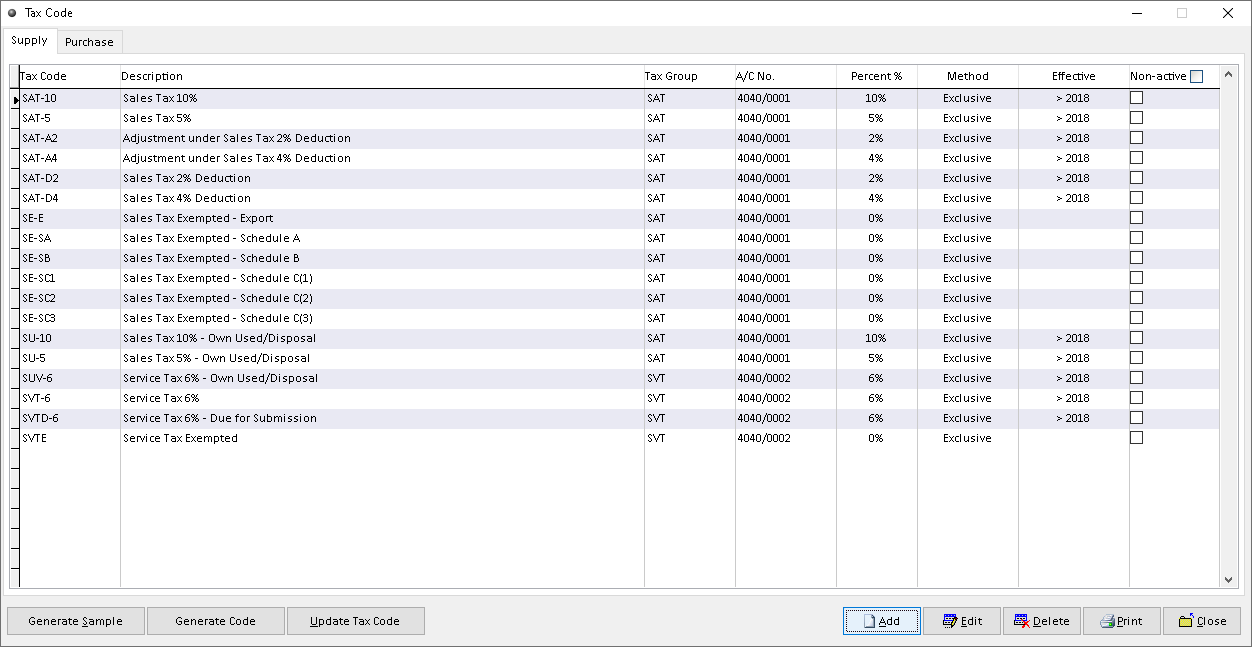

Step 2: Configure SST Tax Codes

Set up the appropriate tax codes based on your business activity:

Example tax codes:

• S-10 / S-5: For 10% or 5% Sales Tax

• SR-6: For 6% Service Tax (standard-rated)

• ZRL / ZRE: Zero-rated Local/Export

• ES43 / DS: Exempt supplies

• Ensure all your product and service listings are linked to the correct codes.

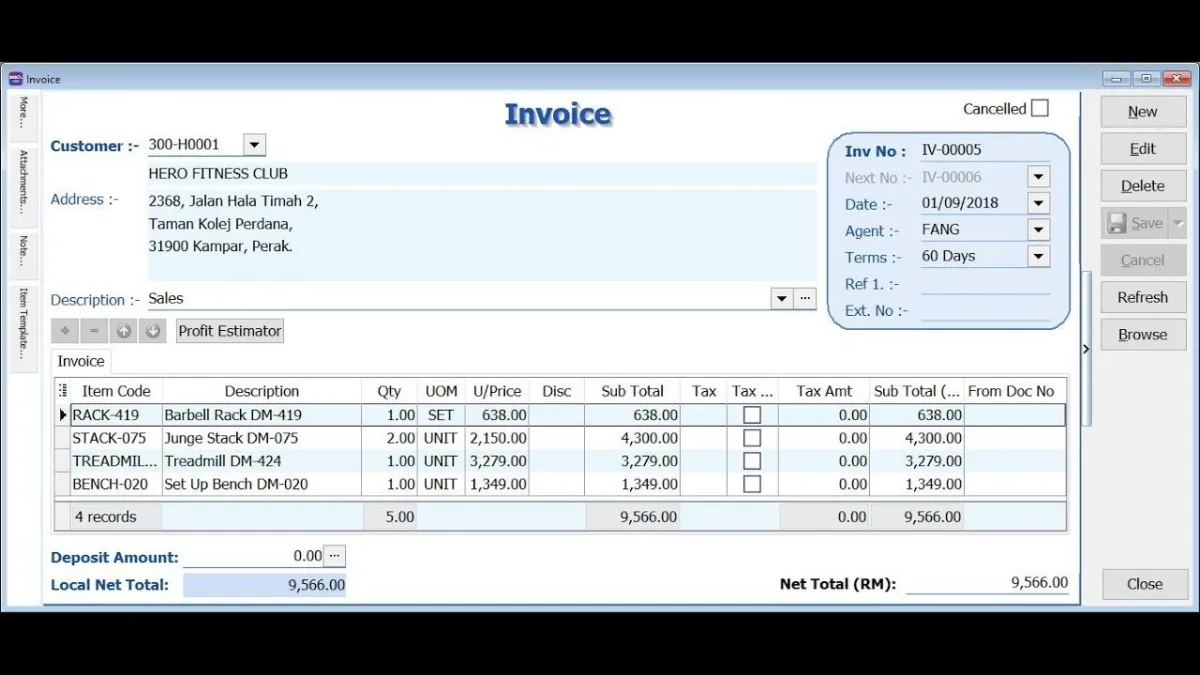

Step 3: Record Transactions Accurately

Every invoice, bill, and payment should be properly recorded:

• Sales invoices: Include SST charges based on the item category

• Purchase invoices: Capture if SST is applicable for your suppliers

• Credit notes/debit notes: Must reflect adjustments correctly

• Your accounting software will automatically compute SST payable based on your entries.

Step 4: Reconcile SST Reports Before Submission

Use the system's SST Summary Report or Tax Report to:

• Review total taxable sales/services

• Check for missing or wrongly coded transactions

• Compare with your bank and cash records

Many platforms allow you to drill down into discrepancies and fix them before finalizing.

Step 5: Generate SST-02 Form Automatically

Once verified, you can usually generate the SST return (SST-02) directly in the software. It includes:

• Total taxable amounts (Sales & Services)

• Tax amounts by category

• Exempted/zero-rated summaries

Download the SST-02 in PDF or XML format for submission.

Bonus Tips to Stay Compliant

• Set reminders: Most software allows recurring alerts before SST due dates

• Audit trail: Choose systems with detailed logs for transaction edits

• Cloud backup: Ensure your data is backed up and secured under PDPA guidelines

• Multi-user control: Let accountants, admin staff, and business owners access only what they need

Common Mistakes to Avoid

• Not classifying services/products under correct tax codes

• Forgetting to account for credit notes or canceled invoices

• Relying on manual Excel spreadsheets without validation

• Late filing or miscalculating turnover thresholds

• Accounting software reduces these risks significantly with automated processes and validation.

Conclusion: Future-Proof Your SST Filing

SST filing doesn’t have to be a tedious, manual process. With the right accounting software, you can streamline your compliance workflow, reduce human error, and focus more on growing your business. As Malaysia continues to push forward with digital initiatives like e-Invoicing and electronic tax submissions, adopting SST-ready accounting solutions today will future-proof your operations tomorrow.

If you haven’t already digitized your SST process, now is the time to explore a solution that aligns with Malaysian tax requirements and helps you file with confidence every cycle.

Take control of your SST compliance today – with the power of accounting software built for Malaysia.

FAQs

Do all businesses in Malaysia need to register for SST?

No. Only businesses that exceed the threshold value set by RMCD (typically RM500,000 annual taxable turnover) are required to register for SST.

What is the difference between Sales Tax and Service Tax?

Sales Tax is charged on manufactured and imported goods, while Service Tax is imposed on specific service providers. A business may be subject to one or both, depending on its activities.

How often do I need to file SST?

SST is typically filed every two months. The due date is the last day of the following month after the taxable period ends.